Flexibility under Uncertainty#

The previous chapter only modelled a single scenario where flexibility was employed. In this chapter, we follow [dNG18] (Chapter 9) in assessing how flexibility can be used to manage, and benefit from, uncertainty.

Multiple Market Scenarios#

If we can produce one future market scenario, we can also produce many. To

incorporate our uncertainty about how future scenarios may unfold, we derive

Market input parameters by sampling from probability distributions that

we suspect are realistic for the market in question.

Market Parameters from Sampling Distributions of their Likelihoods#

Rangekeeper provides alternate methods for Market dynamics modules that

take probability distributions as inputs, rather than single values. These

methods also require us to specify how many iterations (runs, or simulations) we

will produce.

Begin with importing required libraries and configuring our context:

import locale

import warnings

warnings.filterwarnings("ignore")

import pandas as pd

import seaborn as sns

import rangekeeper as rk

locale.setlocale(locale.LC_ALL, 'en_AU')

units = rk.measure.Index.registry

currency = rk.measure.register_currency(registry=units)

Specify how many iterations (scenarios) we will produce. This matches the number of samples we will take from the probability distributions:

iterations = 2000

We also need to define the overall Span of the Market:

frequency = rk.duration.Type.YEAR

num_periods = 25

span = rk.duration.Span.from_duration(

name="Span",

date=pd.Timestamp(2000, 1, 1),

duration=frequency,

amount=num_periods)

sequence = span.to_sequence(frequency=frequency)

Overall Trend#

Following how [dNG18] construct market simulations, a Rangekeeper

Market Trend can sample from distributions defining the growth rate (trend)

and initial rent value.

For initial (rent) value, typically values would not be more than 0.05 or 0.1, at most. Initial rents should be able to be estimated pretty accurately in the realistic pro-forma, especially for existing buildings.

The growth rate distribution reflects uncertainty in the long-run trend growth rate (that applies throughout the entire scenario. In [dNG18], this is modeled as a triangular distribution (though Rangekeeper provides other distributions easily), and the half-range should typically be a small value, at most .01 or .02, unless there is great uncertainty in the long-run average growth rate in the economy (such as perhaps in some emerging market countries), or if one is modeling nominal values and there is great uncertainty about what the future rate of inflation will be (but in such cases it is better to model real values, net of inflation anyway).

(From [dNG18], accompanying Excel spreadsheets)

First we define the distributions:

growth_rate_dist = rk.distribution.Symmetric(

type=rk.distribution.Type.TRIANGULAR,

mean=-.0005,

residual=.005)

initial_value_dist = rk.distribution.Symmetric(

type=rk.distribution.Type.TRIANGULAR,

mean=.05,

residual=.005)

We now produce the resultant Trends:

cap_rate = .05

trends = rk.dynamics.trend.Trend.from_likelihoods(

sequence=sequence,

cap_rate=cap_rate,

growth_rate_dist=growth_rate_dist,

initial_value_dist=initial_value_dist,

iterations=iterations)

We can check that the Trends have been produced as expected:

initial_values = [trend.initial_value for trend in trends]

sns.histplot(

data=initial_values,

bins=20,

kde=True)

<Axes: ylabel='Count'>

Volatility#

Volatility inputs do not require sampling from distributions, but we will be

producing multiple Volatility objects, one for each Trend:

volatility_per_period = .1

autoregression_param = .2

mean_reversion_param = .3

volatilities = rk.dynamics.volatility.Volatility.from_trends(

sequence=sequence,

trends=trends,

volatility_per_period=volatility_per_period,

autoregression_param=autoregression_param,

mean_reversion_param=mean_reversion_param)

Cyclicality#

[dNG18] document multiple means to incorporate estimations of market cycle parameters into a market simulation. Here we replicate the distribution parameters for use in Rangekeeper.

We are agnostic about where the market currently is in the cycle, and want to simulate all possibilities; thus the Space (Rent) Cycle Phase Proportion (of its period) is sampled from a uniform distribution defaulted to a range between 0 & 1):

space_cycle_phase_prop_dist = rk.distribution.Uniform()

The Space (Rent) Cycle Period is a random sample between 10 & 20 years:

space_cycle_period_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.UNIFORM,

mean=15,

residual=5)

The Space (Rent) Cycle peak-to-trough Height is set at 50% (see residual fixed

to 0):

space_cycle_height_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.UNIFORM,

mean=.5,

residual=0)

The Asset (Cap Rate) Cycle Phase differs from the Space Cycle by between -1/10th and 1/10th of the Space Cycle Period:

asset_cycle_phase_diff_prop_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.UNIFORM,

mean=0,

residual=.1)

The Asset (Cap Rate) Cycle Period in between -1 and 1 year different to that of the Space (Rent) Cycle’s

asset_cycle_period_diff_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.UNIFORM,

mean=0,

residual=1)

The Asset (Cap Rate) Cycle Amplitude is fixed to 2%:

asset_cycle_amplitude_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.UNIFORM,

mean=.02,

residual=0.)

For both the Space and Asset Cycles, we remove any cycle asymmetries, in order to align with [dNG18]’s spreadsheet for Chapters 8, 9, 10. In future classes (and possibly future editions), they incorporate cycle asymmetries.

space_cycle_asymmetric_parameter_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.UNIFORM,

mean=0,

residual=0.)

asset_cycle_asymmetric_parameter_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.UNIFORM,

mean=0,

residual=0.)

We now produce the resultant Cycles:

cyclicalities = rk.dynamics.cyclicality.Cyclicality.from_likelihoods(

sequence=sequence,

space_cycle_phase_prop_dist=space_cycle_phase_prop_dist,

space_cycle_period_dist=space_cycle_period_dist,

space_cycle_height_dist=space_cycle_height_dist,

asset_cycle_phase_diff_prop_dist=asset_cycle_phase_diff_prop_dist,

asset_cycle_period_diff_dist=asset_cycle_period_diff_dist,

asset_cycle_amplitude_dist=asset_cycle_amplitude_dist,

space_cycle_asymmetric_parameter_dist=space_cycle_asymmetric_parameter_dist,

asset_cycle_asymmetric_parameter_dist=asset_cycle_asymmetric_parameter_dist,

iterations=iterations)

Noise & Black Swan#

Noise & Black Swan inputs do not require sampling from distributions:

noise = rk.dynamics.noise.Noise(

sequence=sequence,

noise_dist=rk.distribution.Symmetric(

type=rk.distribution.Type.TRIANGULAR,

mean=0.,

residual=.1))

black_swan = rk.dynamics.black_swan.BlackSwan(

sequence=sequence,

likelihood=.05,

dissipation_rate=mean_reversion_param,

probability=rk.distribution.Uniform(),

impact=-.25)

Markets#

Now we can integrate the previous constructs into multiple Market simulations:

markets = rk.dynamics.market.Market.from_likelihoods(

sequence=sequence,

trends=trends,

volatilities=volatilities,

cyclicalities=cyclicalities,

noise=noise,

black_swan=black_swan)

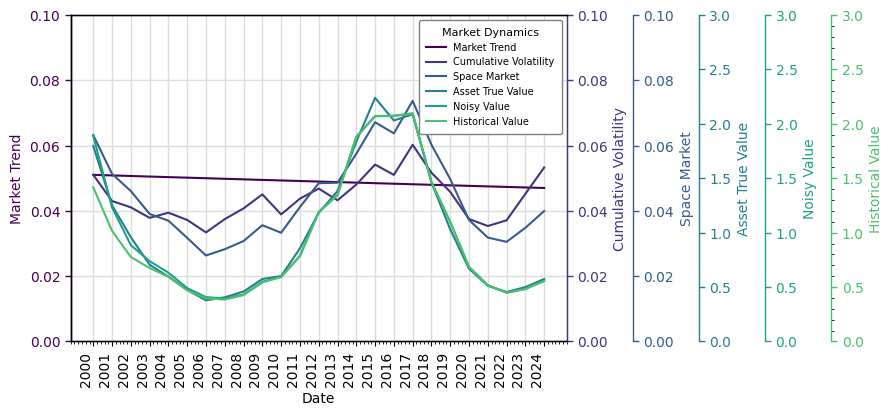

As an example, here is one of the Markets (drawn from the markets by a random integer):

import random

sample_market = markets[random.Random(0).randint(0, iterations - 1)]

table = rk.flux.Stream(

name='Market Dynamics',

flows=[

sample_market.trend,

sample_market.volatility.volatility,

sample_market.volatility.autoregressive_returns,

sample_market.volatility,

sample_market.cyclicality.space_waveform,

sample_market.space_market,

sample_market.cyclicality.asset_waveform,

sample_market.asset_market,

sample_market.asset_true_value,

sample_market.space_market_price_factors,

sample_market.noisy_value,

sample_market.historical_value,

sample_market.implied_rev_cap_rate,

sample_market.returns

],

frequency=frequency)

table.plot(

flows={

'Market Trend': (0, .1),

'Cumulative Volatility': (0, .1),

'Space Market': (0, .1),

'Asset True Value': (0, 3),

'Noisy Value': (0, 3),

'Historical Value': (0, 3)

}

)

Comparing Models#

From [dNG18]: to obtain the value of flexibility, we compare the project utilizing flexibility against a base case or alternative that lacks the particular flexibility or rule we are evaluating. We must expose the inflexible case to the same independent, random future scenarios as the flexible case. We must compute the outcomes for the two cases, inflexible and flexible, under exactly the same scenarios of pricing factor realizations. We can then compare the results of both the inflexible and flexible cases, not only against the (single‐number) traditional pro forma metrics, but also side by side against each other for the entire distribution of possible (ex‐post) outcomes, recognizing the uncertainty and price dynamics that realistically exist.

Inflexible (Base) Model#

Define the Base Model as we did the Ex-Post Inflexible Model in the previous section:

params = {

'start_date': pd.Timestamp('2001-01-01'),

'num_periods': 10,

'frequency': rk.duration.Type.YEAR,

'acquisition_cost': -1000 * currency.units,

'initial_income': 100 * currency.units,

'growth_rate': 0.02,

'vacancy_rate': 0.05,

'opex_pgi_ratio': 0.35,

'capex_pgi_ratio': 0.1,

'exit_caprate': 0.05,

'discount_rate': 0.07

}

For each Market, we then run the Base Model.

To speed this up we can use multiprocessing, so we need to import and configure

a few libraries:

import os

from typing import List

import multiprocess

import pint

pint.set_application_registry(rk.measure.Index.registry)

inflex_scenarios = []

for market in markets:

scenario = BaseModel()

scenario.set_params(params.copy())

scenario.set_market(market)

inflex_scenarios.append(scenario)

def generate(scenario):

scenario.generate()

return scenario

inflex_scenarios = multiprocess.Pool(os.cpu_count()).map(

generate,

inflex_scenarios)

Flexible Model#

Similarly, we set up the Flexible Model with our Policy:

def exceed_pricing_factor(state: rk.flux.Flow) -> List[bool]:

threshold = 1.2

result = []

for i in range(state.movements.index.size):

if any(result):

result.append(False)

else:

if i < 1:

result.append(False)

else:

if state.movements.iloc[i] > threshold:

result.append(True)

else:

result.append(False)

return result

def adjust_hold_period(

model: object,

decisions: List[bool]) -> object:

# Get the index of the decision flag:

try:

idx = decisions.index(True)

except ValueError:

idx = len(decisions)

# Adjust the Model's holding period:

policy_params = model.params.copy()

policy_params['num_periods'] = idx

# Re-run the Model with updated params:

model.set_params(policy_params)

model.generate()

return model

stop_gain_resale_policy = rk.policy.Policy(

condition=exceed_pricing_factor,

action=adjust_hold_period)

And we run the Flexible Model for each Market:

policy_args = [(scenario.market.space_market_price_factors, scenario) for scenario in inflex_scenarios]

flex_scenarios = multiprocess.Pool(os.cpu_count()).map(

stop_gain_resale_policy.execute,

policy_args)

Results#

We can now compare the results of the Base and Flexible Models with some descriptive statistics

import scipy.stats as ss

Time 0 Present Values at OCC#

inflex_pvs = pd.Series([scenario.pvs.movements.iloc[-1] for scenario in inflex_scenarios])

flex_pvs = pd.Series([scenario.pvs.movements.iloc[-1] for scenario in flex_scenarios])

diff_pvs = flex_pvs - inflex_pvs

pvs = pd.DataFrame({

'Inflexible': inflex_pvs,

'Flexible': flex_pvs,

'Difference': diff_pvs})

pvs.describe()

| Inflexible | Flexible | Difference | |

|---|---|---|---|

| count | 2000.000000 | 2000.000000 | 2000.000000 |

| mean | 1072.543062 | 1435.861724 | 363.318662 |

| std | 340.731724 | 409.011430 | 554.795233 |

| min | 522.375230 | 539.226862 | -1399.941700 |

| 25% | 795.217613 | 1199.181323 | -48.021396 |

| 50% | 985.363016 | 1453.376384 | 376.094430 |

| 75% | 1312.603936 | 1713.210422 | 752.969720 |

| max | 2399.276122 | 2697.902717 | 1853.843909 |

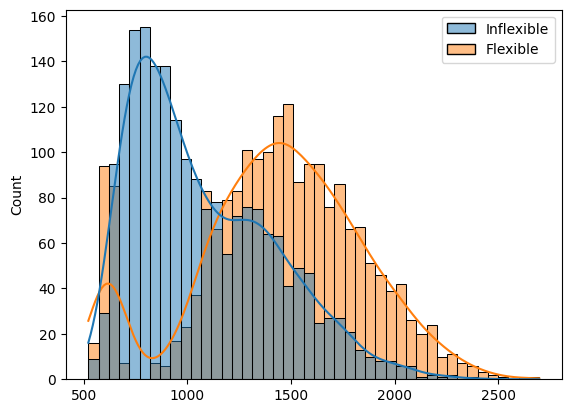

At a high level, we can see from the mean and median (50th percentile) results that the Flexible Model produces a higher PV than the Inflexible Model (by about $400. However, there still is a significant distortion of the distributions from normal, as can be seen in the skewness and kurtosis statistics.

pvs.skew()

Inflexible 0.784544

Flexible -0.265706

Difference -0.017136

dtype: float64

pvs.kurtosis()

Inflexible -0.032361

Flexible -0.116688

Difference -0.582599

dtype: float64

print('PV Diffs t-stat: \n{}'.format(

ss.ttest_1samp(diff_pvs, 0)))

PV Diffs t-stat:

TtestResult(statistic=np.float64(29.286669325536923), pvalue=np.float64(3.439977994505339e-157), df=np.int64(1999))

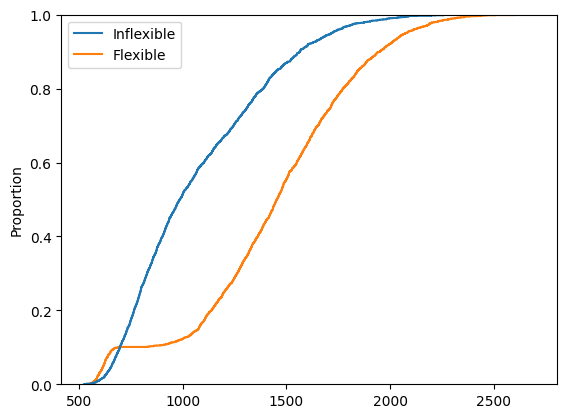

PVs Cumulative Distribution (‘Target Curves’)#

To get a better idea of just how the Flexible Model outperforms the Inflexible Model, we can plot their distributions of outcomes

Present Values#

sns.histplot(

data=pvs.drop(columns=['Difference']),

binwidth=50,

kde=True

)

<Axes: ylabel='Count'>

To make reading the plot easier and identify just how and when the Flexible model outperforms the Inflexible, we can also plot the cumulative distribution of the PVs:

sns.ecdfplot(

data=pvs.drop(columns=['Difference']))

<Axes: ylabel='Proportion'>

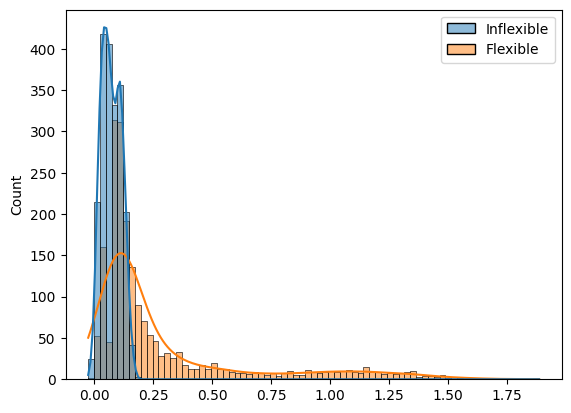

Realized IRR at Market Value Price#

inflex_irrs = pd.Series([scenario.irrs.movements.iloc[-1] for scenario in inflex_scenarios])

flex_irrs = pd.Series([scenario.irrs.movements.iloc[-1] for scenario in flex_scenarios])

diff_irrs = flex_irrs - inflex_irrs

irrs = pd.DataFrame({

'Inflexible': inflex_irrs,

'Flexible': flex_irrs,

'Difference': diff_irrs})

irrs.describe()

| Inflexible | Flexible | Difference | |

|---|---|---|---|

| count | 2000.000000 | 2000.000000 | 2000.000000 |

| mean | 0.071297 | 0.284939 | 0.213642 |

| std | 0.040244 | 0.346125 | 0.358724 |

| min | -0.021319 | -0.026725 | -0.158996 |

| 25% | 0.038459 | 0.092533 | 0.000000 |

| 50% | 0.068040 | 0.135949 | 0.059050 |

| 75% | 0.104341 | 0.295923 | 0.246092 |

| max | 0.177128 | 1.886756 | 1.841387 |

irrs.skew()

Inflexible 0.157770

Flexible 2.020676

Difference 1.942266

dtype: float64

irrs.kurtosis()

Inflexible -0.881679

Flexible 3.227400

Difference 2.925669

dtype: float64

print('IRR Diffs t-stat: \n{}'.format(

ss.ttest_1samp(diff_irrs, 0)))

IRR Diffs t-stat:

TtestResult(statistic=np.float64(26.634315152743138), pvalue=np.float64(5.126810916784482e-134), df=np.int64(1999))

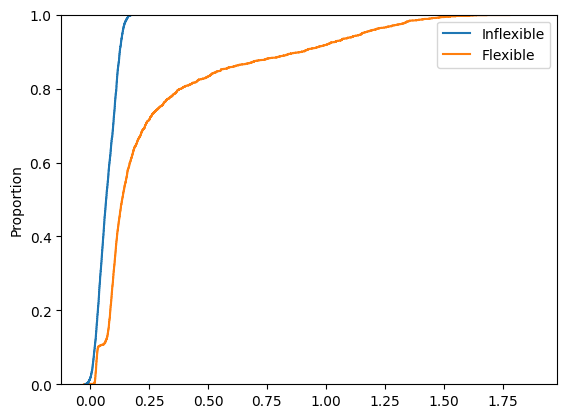

IRRs Cumulative Distribution (‘Target Curves’)#

g = sns.histplot(

data=irrs.drop(columns=['Difference']),

binwidth=.025,

kde=True

)

sns.ecdfplot(

data=irrs.drop(columns=['Difference']))

<Axes: ylabel='Proportion'>

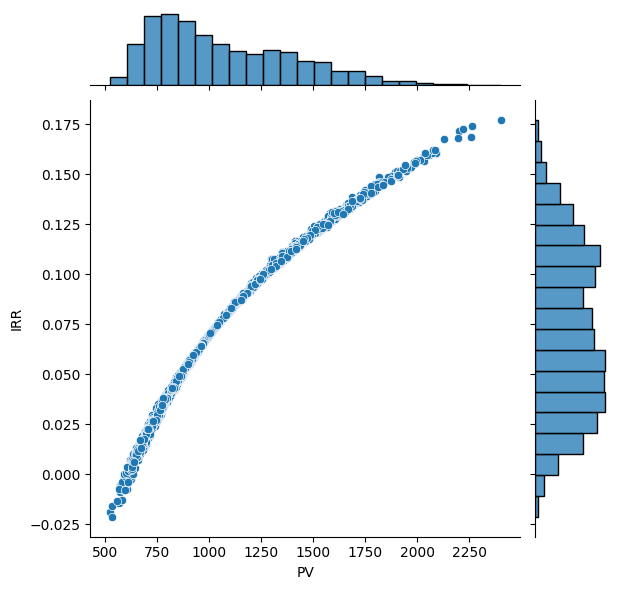

IRRs x PVs#

Inflexible Model#

inflex_irr_x_pv = pd.DataFrame({

'PV': inflex_pvs,

'IRR': inflex_irrs,})

sns.jointplot(

data=inflex_irr_x_pv,

x='PV',

y='IRR',

kind='scatter')

<seaborn.axisgrid.JointGrid at 0x37af26ab0>

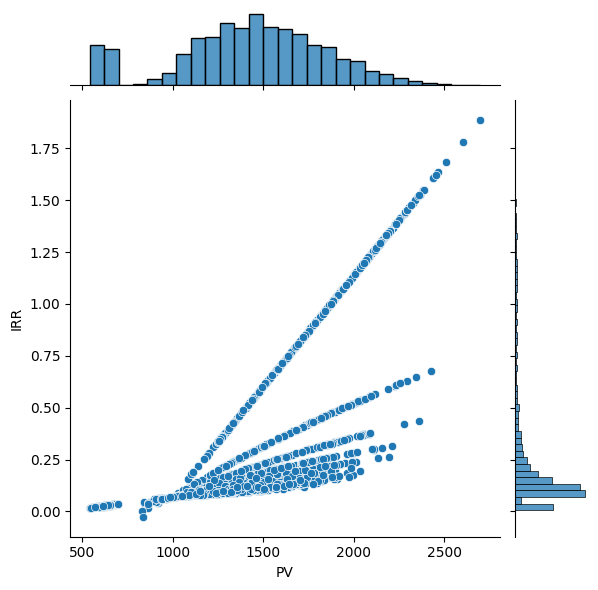

Flexible Model#

flex_irr_x_pv = pd.DataFrame({

'PV': flex_pvs,

'IRR': flex_irrs})

sns.jointplot(

data=flex_irr_x_pv,

x='PV',

y='IRR',

kind='scatter')

<seaborn.axisgrid.JointGrid at 0x378d7dac0>

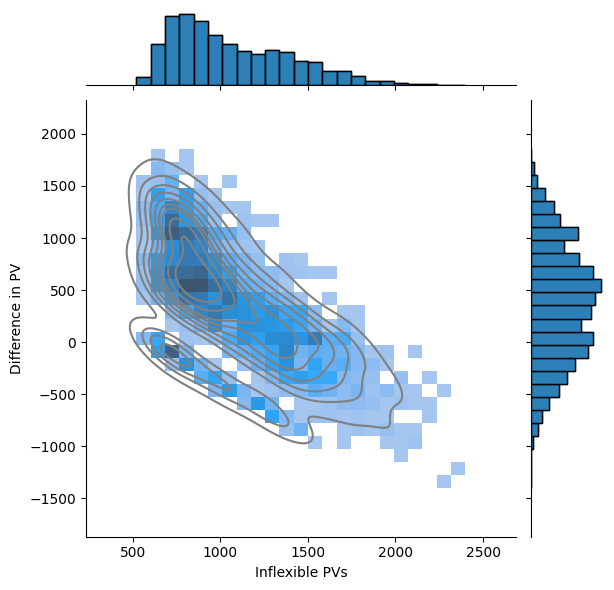

PVs Diffs#

PV Difference as a function of Inflex PV#

diff_pvs_x_inflex_pvs = pd.DataFrame({

'Inflexible PVs': inflex_pvs,

'Difference in PV': diff_pvs})

g = sns.jointplot(

data=diff_pvs_x_inflex_pvs,

x='Inflexible PVs',

y='Difference in PV',

kind='hist')

g.plot_joint(

sns.kdeplot,

color='grey',

zorder=1,

levels=10)

g.plot_marginals(

sns.histplot

)

<seaborn.axisgrid.JointGrid at 0x37acca330>

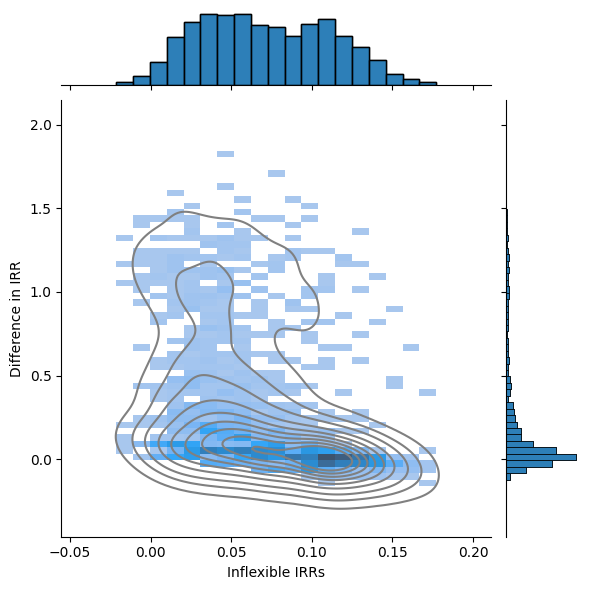

IRR Difference as a function of Inflex IRR#

diff_irrs_x_inflex_irrs = pd.DataFrame({

'Inflexible IRRs': inflex_irrs,

'Difference in IRR': diff_irrs})

g = sns.jointplot(

data=diff_irrs_x_inflex_irrs,

x='Inflexible IRRs',

y='Difference in IRR',

kind='hist')

g.plot_joint(

sns.kdeplot,

color='grey',

zorder=1,

levels=10)

g.plot_marginals(

sns.histplot

)

<seaborn.axisgrid.JointGrid at 0x302bda930>