Driving a Financial Valuation from a Design#

As seen in

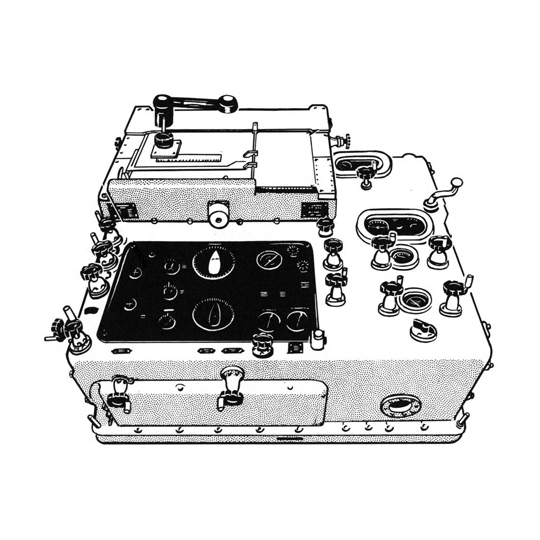

Loading a Design, a design’s object model (a

knowledge graph including all

its spatial and semantic relationships) can be loaded via Speckle from any of

Speckle’s supported connectors, so

long as those objects (Entitys and Relationships) have been assigned.

In this notebook, we will demonstrate how to integrate financial modelling into

the object model (graph) in order to derive the financial valuation of a real

estate property from its spatial design.

This is done by calculating cash flows per Entity, and then using the

Relationships to aggregate those Flows into appropriate Streams.

Load the Design#

We will use the same design as in the previous notebook.

import os

import locale

import urllib.parse

import json

import pandas as pd

import networkx as nx

from IPython.display import IFrame

import plotly.subplots

import plotly.offline as py

from specklepy.api import operations, client

from specklepy.transports.server import ServerTransport

# Load environment variables from .env file

import dotenv

dotenv.load_dotenv(dotenv.find_dotenv())

import rangekeeper as rk

speckle = client.SpeckleClient(host="app.speckle.systems")

speckle.authenticate_with_token(os.getenv("SPECKLE_TOKEN"))

print(f"\n✓ Authenticated as: {speckle.account.userInfo.name}")

# Explore the Speckle Project, Model, and Versions

project = speckle.project.get_with_models("c0f66c35e3")

print(f"Project: {project.name}, ID: {project.id}")

print(

f"Models: {[model.name for model in project.models.items]}, {[model.id for model in project.models.items]}"

)

model = speckle.model.get_with_versions(

project_id=project.id,

model_id="119ad04487",

)

print(

f"Model: {model.name}, Versions: {[version.id for version in model.versions.items]}"

)

IFrame(f"https://app.speckle.systems/projects/{project.id}/models/{model.id}", width='100%', height=800)

✓ Authenticated as: Daniel Fink

Project: RangekeeperDemo, ID: c0f66c35e3

Models: ['main'], ['119ad04487']

Model: main, Versions: ['9a9670946f']

Inspect the Model Graph#

# Load the root Speckle Object of the design

transport = ServerTransport(stream_id="c0f66c35e3", client=speckle)

root = operations.receive(

obj_id="e7acaac21ae7e9369339900a4aaeb827",

remote_transport=transport,

)

parsed = rk.api.Speckle.parse(base=root['@property'])

property = rk.api.Speckle.to_rk(

bases=list(parsed.values()),

name='property',

type='archetype')

Warning: Duplicate Entity 6496e279-88ca-49f4-b48c-6c0f156e0a58 [utilities] found.

Existing Entity is an Assembly while new Entity is not. Keeping Assembly.

Warning: Duplicate Entity 6496e279-88ca-49f4-b48c-6c0f156e0a58 [utilities] found.

Existing Entity is an Assembly while new Entity is not. Keeping Assembly.

Warning: Duplicate Entity 6496e279-88ca-49f4-b48c-6c0f156e0a58 [utilities] found.

Existing Entity is an Assembly while new Entity is not. Keeping Assembly.

Warning: Duplicate Entity 2b51847e-ec54-415d-afa0-ce32d74c6144 [plinthparking] found.

Existing Entity is an Assembly while new Entity is not. Keeping Assembly.

property.plot(name=f'_static/{property.name}')

IFrame(src=f'_static/{property.name}.html', width='100%', height=800)

_static/property.html

Assigning and Aggregating Flows per Entity#

Now we can organise the two main categories of cash flows (costs and revenues)

according to the Relationship types in the design.

In this example, revenue-based cash flows are generated by Entitys that have a

measureable floor area – in this case, anything that has a ‘gfa’ property.

We can query the graph to find them:

Revenue-producing Entities#

Revenue-producing Entitys will be aggregated by their spatial containment. So

we can first slice our graph to a tree of nodes that have “contains”

relationships:

spatial_containment = property.filter_by_type(

relationship_type='spatiallyContains',

name='spatial_containment')

Note: we anticipate that the spatial decomposition is completely hierarchical (i.e., no spaces overlap, which means no spaces have multiple parents). We can check this by testing whether the containment graph is a “tree” (or “arborescence”: see NetworkX Tree).

nx.is_arborescence(spatial_containment.graph)

True

# Plot the spatial containment graph

spatial_containment.plot(name='_static/spatial_containment')

IFrame(src="_static/spatial_containment.html", width="100%", height=800)

_static/spatial_containment.html

Simple Aggregation#

Now that we have verified this, we can continue with a simple aggregation. We

wish to aggregate up through our hierarchy all Entitys that have a Gross Floor

Area (‘gfa’) property. Rangekeeper provides defaults for the Entity.aggregate()

method for this, whereby a named property of any Entity is summed (numerical

addition) into its parent Entity against a specified label:

property.aggregate(

property='gfa',

label='subtotal_gfa',

relationship_type='spatiallyContains')

We can tabulate this by converting the graph to a pandas DataFrame. Note that

the graph nodes (as witnessed in the DataFrame’s index and ‘parent’ column)

are GUID strings. Each of these have corresponding Entity objects, organised

via NetworkX’s Node Attributes. See NetworkX Tutorial

df = spatial_containment.to_DataFrame()

df = df[['name', 'type', 'gfa', 'subtotal_gfa', 'parent', 'use', 'ffl', 'number']]

df

| name | type | gfa | subtotal_gfa | parent | use | ffl | number | |

|---|---|---|---|---|---|---|---|---|

| afe8e730-ad0f-4c2a-a15c-e249e4518fa8 | property | property | NaN | 42786.259115 | None | NaN | NaN | NaN |

| 0a0a97ef-431d-471d-bc33-ace7e7df5fcb | plinth | building | NaN | 12773.744211 | afe8e730-ad0f-4c2a-a15c-e249e4518fa8 | NaN | NaN | NaN |

| 5ebb9736-5f18-4103-a5a4-040cd2e9b019 | buildingA | building | NaN | 16575.630074 | afe8e730-ad0f-4c2a-a15c-e249e4518fa8 | NaN | NaN | NaN |

| a1e00481-e51e-47c5-b629-8b214c0900bd | buildingB | building | NaN | 13436.884829 | afe8e730-ad0f-4c2a-a15c-e249e4518fa8 | NaN | NaN | NaN |

| 6496e279-88ca-49f4-b48c-6c0f156e0a58 | utilities | utilities | NaN | 0.000000 | afe8e730-ad0f-4c2a-a15c-e249e4518fa8 | NaN | NaN | NaN |

| 2b51847e-ec54-415d-afa0-ce32d74c6144 | plinthparking | space | NaN | 12773.744211 | 0a0a97ef-431d-471d-bc33-ace7e7df5fcb | parking | NaN | NaN |

| 938f4cf1-d307-4160-9538-d4bfa9583ad8 | plinthplant | utilities | NaN | 0.000000 | 0a0a97ef-431d-471d-bc33-ace7e7df5fcb | plant | NaN | NaN |

| e84b8c35-fd4a-49fc-b4c9-e318a958685b | plinthparkingFloor-2 | floor | 6386.872106 | 6386.872106 | 2b51847e-ec54-415d-afa0-ce32d74c6144 | NaN | -5.9 | -2.0 |

| c3ebe151-1e0c-45c6-8852-7ea21f72290e | plinthparkingFloor-1 | floor | 6386.872106 | 6386.872106 | 2b51847e-ec54-415d-afa0-ce32d74c6144 | NaN | -2.8 | -1.0 |

| c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | buildingAhotel | space | NaN | 11716.690054 | 5ebb9736-5f18-4103-a5a4-040cd2e9b019 | hotel | NaN | NaN |

| 1d0841bf-aa28-41d7-ba75-0ad0f3d57d21 | buildingAretail | space | NaN | 789.114895 | 5ebb9736-5f18-4103-a5a4-040cd2e9b019 | retail | NaN | NaN |

| 7716632b-f43c-4ed2-9f84-26709361bbfe | buildingAresidential | space | NaN | 2308.322369 | 5ebb9736-5f18-4103-a5a4-040cd2e9b019 | residential | NaN | NaN |

| 01aec121-ef19-4e6d-9f09-b2ce007b717d | buildingAretail | space | NaN | 722.715820 | 5ebb9736-5f18-4103-a5a4-040cd2e9b019 | retail | NaN | NaN |

| 6f6b227b-b28b-4412-89bd-0a9bbc47164e | buildingAparking | space | NaN | 1038.786936 | 5ebb9736-5f18-4103-a5a4-040cd2e9b019 | parking | NaN | NaN |

| 7eec5208-fc0e-4dfd-bd0b-b1d226b2e97e | buildingAcores | utilities | NaN | 0.000000 | 5ebb9736-5f18-4103-a5a4-040cd2e9b019 | cores | NaN | NaN |

| bc265fcf-d0f6-4d22-8e92-d8f86f4d707a | buildingAhotelFloor0 | floor | 111.690000 | 111.690000 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 0.3 | 0.0 |

| 22851887-f9ee-4aa8-8755-bc021c3a3b30 | buildingAhotelFloor1 | floor | 1697.451572 | 1697.451572 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 5.3 | 1.0 |

| d67cc046-9c03-4e43-b1b5-876417dbcdda | buildingAhotelFloor2 | floor | 1270.128420 | 1270.128420 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 8.4 | 2.0 |

| 5f90565d-44c0-4de2-b510-d263599953f5 | buildingAhotelFloor3 | floor | 1068.208325 | 1068.208325 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 11.5 | 3.0 |

| f7b76e8b-93f0-47c6-8666-05c541c19e25 | buildingAhotelFloor4 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 14.6 | 4.0 |

| 9bdec185-a51b-4845-b746-ddcd3e3fa433 | buildingAhotelFloor5 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 17.7 | 5.0 |

| 250edc28-32de-4633-add0-a384305b5e87 | buildingAhotelFloor6 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 20.8 | 6.0 |

| e4f25e01-0e9d-4fd2-b705-96d118802468 | buildingAhotelFloor7 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 23.9 | 7.0 |

| 9582fd3c-ce66-42c7-8675-39b04b7a4689 | buildingAhotelFloor8 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 27.0 | 8.0 |

| 9151983a-1344-4c88-81f3-76cd4ca8ec6d | buildingAhotelFloor9 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 30.1 | 9.0 |

| 56eec388-d1bb-4de7-92a8-be8202d5be2d | buildingAhotelFloor10 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 33.2 | 10.0 |

| 49d884ea-f590-46a3-a662-db5e73190848 | buildingAhotelFloor11 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 36.3 | 11.0 |

| 192fb1b2-fc6c-4b42-8135-45cbcbead777 | buildingAhotelFloor12 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 39.4 | 12.0 |

| 85305abb-0e6f-4c8f-bf27-553292e317e9 | buildingAhotelFloor13 | floor | 756.921174 | 756.921174 | c0348c0f-a31f-421b-b6bc-0fe0d5ea947f | NaN | 42.5 | 13.0 |

| 75c85658-55c8-4bd0-9d0c-c03a9b2c6169 | buildingAretailFloor0 | floor | 789.114895 | 789.114895 | 1d0841bf-aa28-41d7-ba75-0ad0f3d57d21 | NaN | 0.3 | 0.0 |

| bf5a4444-6abd-4b89-b7a8-d758df5134fe | buildingAresidentialFloor0 | floor | 57.900000 | 57.900000 | 7716632b-f43c-4ed2-9f84-26709361bbfe | NaN | 0.3 | 0.0 |

| dbf25b07-6f85-45bb-905c-de5b8562f5e7 | buildingAresidentialFloor1 | floor | 750.140790 | 750.140790 | 7716632b-f43c-4ed2-9f84-26709361bbfe | NaN | 5.3 | 1.0 |

| 507e4ef2-fe13-44d7-af5f-bcf717b3de53 | buildingAresidentialFloor2 | floor | 750.140790 | 750.140790 | 7716632b-f43c-4ed2-9f84-26709361bbfe | NaN | 8.4 | 2.0 |

| bb815059-7516-45df-8fac-16f0e62242f3 | buildingAresidentialFloor3 | floor | 750.140790 | 750.140790 | 7716632b-f43c-4ed2-9f84-26709361bbfe | NaN | 11.5 | 3.0 |

| d45316af-5763-4b39-8e39-dc7645c39ec2 | buildingAretailFloor0 | floor | 722.715820 | 722.715820 | 01aec121-ef19-4e6d-9f09-b2ce007b717d | NaN | 0.3 | 0.0 |

| 99dae6a3-d102-4525-9f3a-b8ee50a9c45f | buildingAparkingFloor0 | floor | 1038.786936 | 1038.786936 | 6f6b227b-b28b-4412-89bd-0a9bbc47164e | NaN | 0.3 | 0.0 |

| e9acc93a-6f25-4179-97b3-594d1927565a | buildingBresidential | space | NaN | 11442.736624 | a1e00481-e51e-47c5-b629-8b214c0900bd | residential | NaN | NaN |

| eb1a8e6c-abf7-4fde-be66-b79a53eb7d52 | buildingBparking | space | NaN | 1178.164752 | a1e00481-e51e-47c5-b629-8b214c0900bd | parking | NaN | NaN |

| 34e63754-df1f-4c4d-b480-afa4109b3a5a | buildingBretail | space | NaN | 815.983454 | a1e00481-e51e-47c5-b629-8b214c0900bd | retail | NaN | NaN |

| cb5a02f7-b1b9-4a32-95b8-bbb70a946230 | buildingBcores | utilities | NaN | 0.000000 | a1e00481-e51e-47c5-b629-8b214c0900bd | cores | NaN | NaN |

| 0c018f4e-85d1-45ca-a83a-e3047e63ea6e | buildingBresidentialFloor0 | floor | 765.941631 | 765.941631 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 0.3 | 0.0 |

| 5ffdc26b-ed78-45e7-95a7-93114f38437b | buildingBresidentialFloor1 | floor | 2361.056035 | 2361.056035 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 5.3 | 1.0 |

| 15c0f8fb-5a62-4f60-94fc-5f1ea1a79f76 | buildingBresidentialFloor2 | floor | 2361.056035 | 2361.056035 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 8.4 | 2.0 |

| aece3428-b220-4ced-a819-15cdb72166aa | buildingBresidentialFloor3 | floor | 2015.956035 | 2015.956035 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 11.5 | 3.0 |

| 1b966f89-f491-425e-9da1-ad0ad124cae4 | buildingBresidentialFloor4 | floor | 2015.956035 | 2015.956035 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 14.6 | 4.0 |

| f3ff41c9-c6e6-4bcb-8d36-c7acfbecf839 | buildingBresidentialFloor5 | floor | 875.014900 | 875.014900 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 17.7 | 5.0 |

| 1df6c7b8-7e0a-4347-b94c-82324a5c4765 | buildingBresidentialFloor6 | floor | 875.014900 | 875.014900 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 20.8 | 6.0 |

| 7f876f6b-5eef-44d0-b9be-39b08176e2e4 | buildingBresidentialFloor0 | floor | 172.741054 | 172.741054 | e9acc93a-6f25-4179-97b3-594d1927565a | NaN | 0.3 | 0.0 |

| 3623f3aa-9226-46d1-9e2f-b3e82e0f187f | buildingBparkingFloor0 | floor | 1178.164752 | 1178.164752 | eb1a8e6c-abf7-4fde-be66-b79a53eb7d52 | NaN | 0.3 | 0.0 |

| bb756739-0f7c-43ec-874a-ec0def2ca9e4 | buildingBretailFloor0 | floor | 815.983454 | 815.983454 | 34e63754-df1f-4c4d-b480-afa4109b3a5a | NaN | 0.3 | 0.0 |

We can also plot this as a hierarchical pie chart (a.k.a. ‘sunburst’ chart), or a treemap:

sunburst = spatial_containment.sunburst(property='subtotal_gfa')

treemap = spatial_containment.treemap(property='subtotal_gfa')

fig = plotly.subplots.make_subplots(

rows=2, cols=1,

specs=[[{"type": "sunburst"}], [{"type": "treemap"}]],

subplot_titles=('Gross Floor Area - Sunburst Plot', 'Gross Floor Area - Treemap Plot'))

fig.append_trace(sunburst, row=1, col=1)

fig.append_trace(treemap, row=2, col=1)

filename='spatial_containment_chart.html'

py.plot(fig, filename=f'_static/{filename}', auto_open=False)

IFrame(src=f'_static/{filename}', width='100%', height=800 * len(fig.data))

Aggregating a (Financial) Calculation#

A more complex aggregation involves collecting specific cash Flows into

Streams per Entity/Assembly; for instance, we may want to aggregate all

revenues generated by lettable floorspace into their respective parent Entitys,

in order to analyse or compare the performance of the design at different

resolutions.

We start by identifying which Entitys are ‘floor’ types and have an area

measurement:

floors = property.filter_by_type(entity_type='floor')

floors = [floor for floor in floors.get_entities().values() if hasattr(floor, 'gfa')]

For each floor we can project a set of simple cash flows, in a similar manner to A Basic DCF Valuation.

First initialize our locale, and a set of parameters, including some around area efficiency ratios, initial incomes per area, and growth rates:

locale.setlocale(locale.LC_ALL, 'en_au')

units = rk.measure.Index.registry

currency = rk.measure.register_currency(registry=units)

frequency = rk.duration.Type.YEAR

efficiency_ratios = dict(

hotel=0.8,

retail=0.675,

residential=0.75,

parking=0.9

)

initial_income_per_area_pa = dict(

hotel=750,

retail=1000,

residential=600,

parking=0

)

pgi_growth_rates = dict(

hotel=.035,

retail=.075,

residential=.055,

parking=0

)

vacancy_rates = dict(

hotel=.025,

retail=.075,

residential=.015,

parking=0,

)

revenue_inputs = pd.DataFrame(

data=dict(

efficiency_ratio=efficiency_ratios,

initial_income_per_area_pa=initial_income_per_area_pa,

pgi_growth_rate=pgi_growth_rates,

vacancy_rate=vacancy_rates,

))

revenue_inputs

| efficiency_ratio | initial_income_per_area_pa | pgi_growth_rate | vacancy_rate | |

|---|---|---|---|---|

| hotel | 0.800 | 750 | 0.035 | 0.025 |

| retail | 0.675 | 1000 | 0.075 | 0.075 |

| residential | 0.750 | 600 | 0.055 | 0.015 |

| parking | 0.900 | 0 | 0.000 | 0.000 |

params = dict(

start_date=pd.Timestamp('2001-01-01'),

num_periods=10,

frequency=rk.duration.Type.YEAR

)

Streams of Revenue Flows per Entity:#

We can now construct a set of cash flows per Entity in our design for our

asset. We will use a similar structure to the previous notebooks.

First we will define a general ‘Spans’ class that defines the time periods. This can be used by any subsequent calculations:

class Spans:

def __init__(self, params: dict):

self.params = params

self.calc_span = rk.duration.Span.from_duration(

name='Span to Calculate Reversion',

date=self.params['start_date'],

duration=self.params['frequency'],

amount=self.params['num_periods'] + 1)

self.acq_span = rk.duration.Span.from_duration(

name='Acquisition Span',

date=rk.duration.offset(

self.params['start_date'],

amount=-1,

duration=self.params['frequency']),

duration=self.params['frequency'])

self.span = self.calc_span.extend(

name='Span',

amount=-1,

duration=self.params['frequency'])

Then, we will define a Revenues class that holds the parameters:

class Revenues:

def __init__(

self,

params: dict,

spans: Spans):

self.params = params

self.spans = spans

And then we add Revenue Flows:

@rk.update_class(Revenues)

class Revenues:

def generate(self):

self.pgi = rk.flux.Flow.from_projection(

name='Potential Gross Income',

value=self.params['initial_income'],

proj=rk.projection.Extrapolation(

form=rk.extrapolation.Compounding(

rate=self.params['pgi_growth_rate']),

sequence=self.spans.calc_span.to_sequence(frequency=self.params['frequency'])),

units=currency.units)

self.vacancy = rk.flux.Flow(

name='Vacancy Allowance',

movements=self.pgi.movements * -self.params['vacancy_rate'],

units=currency.units)

self.egi = rk.flux.Stream(

name='Effective Gross Income',

flows=[self.pgi, self.vacancy],

frequency=self.params['frequency'])

Now we need to add Entity-specific parameters to the parameters dictionary,

and run the init_spans() and init_flows() methods per floor Entity:

(Note we place the resultant Stream in the events attribute of the Entity)

spans = Spans(params)

for floor in floors:

parent = floor.get_relatives(

relationship_type='spatiallyContains',

outgoing=False,

assembly=spatial_containment)[0]

floor['use'] = parent['use']

floor.params = params.copy()

floor.params['initial_income'] = initial_income_per_area_pa[floor['use']] * floor['gfa'] * efficiency_ratios[floor['use']]

floor.params['pgi_growth_rate'] = pgi_growth_rates[floor['use']]

floor.params['vacancy_rate'] = vacancy_rates[floor['use']]

revenues = Revenues(floor.params, spans)

revenues.generate()

floor['pgi'] = revenues.pgi

floor['vacancy'] = revenues.vacancy

floor['egi'] = revenues.egi

Aggregating by Parent Container#

Since we have the “containment” hierarchy, we can aggregate the Revenues per

parent Entity:

Rangekeeper provides some helper methods to assist in the aggregation of

Streams and Flows; specifically, since the Entity.aggregate() method

updates a specified Entity’s property with a dictionary of subentity

properties, keyed by their respective entityIds, we can use the

aggregate_flows() function to support the collation of child Entity

Flows into a single Stream in a new property label in the Entity

def aggregate_egis(**kwargs):

return rk.graph.Entity.aggregate_flows(

**kwargs,

name='Effective Gross Income',

frequency=frequency)

This function is passed into the Entity.aggregate() method as the function

parameter:

property.aggregate(

function=aggregate_egis,

property='egi',

label='subtotal_egi',

relationship_type='spatiallyContains')

Now we can look at what the aggregate method has produced for a single floor:

floors[1]['egi'].name

'Effective Gross Income'

We can then inspect the aggregate_egi property of an Entity, which holds a

Stream of Flows (each coming from a child of that Entity). Let’s use the

hotel compartment in Building A:

buildingAhotel = [e for (id, e) in spatial_containment.get_entities().items() if e.name == 'buildingAhotel'][0]

print(buildingAhotel.name)

buildingAhotel['subtotal_egi']

buildingAhotel

| Effective Gross Income for bc265fcf-d0f6-4d22-8e92-d8f86f4d707a [buildingAhotelFloor0] | Effective Gross Income for 22851887-f9ee-4aa8-8755-bc021c3a3b30 [buildingAhotelFloor1] | Effective Gross Income for d67cc046-9c03-4e43-b1b5-876417dbcdda [buildingAhotelFloor2] | Effective Gross Income for 5f90565d-44c0-4de2-b510-d263599953f5 [buildingAhotelFloor3] | Effective Gross Income for f7b76e8b-93f0-47c6-8666-05c541c19e25 [buildingAhotelFloor4] | Effective Gross Income for 9bdec185-a51b-4845-b746-ddcd3e3fa433 [buildingAhotelFloor5] | Effective Gross Income for 250edc28-32de-4633-add0-a384305b5e87 [buildingAhotelFloor6] | Effective Gross Income for e4f25e01-0e9d-4fd2-b705-96d118802468 [buildingAhotelFloor7] | Effective Gross Income for 9582fd3c-ce66-42c7-8675-39b04b7a4689 [buildingAhotelFloor8] | Effective Gross Income for 9151983a-1344-4c88-81f3-76cd4ca8ec6d [buildingAhotelFloor9] | Effective Gross Income for 56eec388-d1bb-4de7-92a8-be8202d5be2d [buildingAhotelFloor10] | Effective Gross Income for 49d884ea-f590-46a3-a662-db5e73190848 [buildingAhotelFloor11] | Effective Gross Income for 192fb1b2-fc6c-4b42-8135-45cbcbead777 [buildingAhotelFloor12] | Effective Gross Income for 85305abb-0e6f-4c8f-bf27-553292e317e9 [buildingAhotelFloor13] | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2001 | $65,338.65 | $993,009.17 | $743,025.13 | $624,901.87 | $442,798.89 | $442,798.89 | $442,798.89 | $442,798.89 | $442,798.89 | $442,798.89 | $442,798.89 | $442,798.89 | $442,798.89 | $442,798.89 |

| 2002 | $67,625.50 | $1,027,764.49 | $769,031.00 | $646,773.44 | $458,296.85 | $458,296.85 | $458,296.85 | $458,296.85 | $458,296.85 | $458,296.85 | $458,296.85 | $458,296.85 | $458,296.85 | $458,296.85 |

| 2003 | $69,992.40 | $1,063,736.25 | $795,947.09 | $669,410.51 | $474,337.24 | $474,337.24 | $474,337.24 | $474,337.24 | $474,337.24 | $474,337.24 | $474,337.24 | $474,337.24 | $474,337.24 | $474,337.24 |

| 2004 | $72,442.13 | $1,100,967.02 | $823,805.24 | $692,839.87 | $490,939.04 | $490,939.04 | $490,939.04 | $490,939.04 | $490,939.04 | $490,939.04 | $490,939.04 | $490,939.04 | $490,939.04 | $490,939.04 |

| 2005 | $74,977.60 | $1,139,500.86 | $852,638.42 | $717,089.27 | $508,121.91 | $508,121.91 | $508,121.91 | $508,121.91 | $508,121.91 | $508,121.91 | $508,121.91 | $508,121.91 | $508,121.91 | $508,121.91 |

| 2006 | $77,601.82 | $1,179,383.39 | $882,480.77 | $742,187.39 | $525,906.17 | $525,906.17 | $525,906.17 | $525,906.17 | $525,906.17 | $525,906.17 | $525,906.17 | $525,906.17 | $525,906.17 | $525,906.17 |

| 2007 | $80,317.88 | $1,220,661.81 | $913,367.59 | $768,163.95 | $544,312.89 | $544,312.89 | $544,312.89 | $544,312.89 | $544,312.89 | $544,312.89 | $544,312.89 | $544,312.89 | $544,312.89 | $544,312.89 |

| 2008 | $83,129.01 | $1,263,384.97 | $945,335.46 | $795,049.69 | $563,363.84 | $563,363.84 | $563,363.84 | $563,363.84 | $563,363.84 | $563,363.84 | $563,363.84 | $563,363.84 | $563,363.84 | $563,363.84 |

| 2009 | $86,038.52 | $1,307,603.45 | $978,422.20 | $822,876.43 | $583,081.58 | $583,081.58 | $583,081.58 | $583,081.58 | $583,081.58 | $583,081.58 | $583,081.58 | $583,081.58 | $583,081.58 | $583,081.58 |

| 2010 | $89,049.87 | $1,353,369.57 | $1,012,666.98 | $851,677.11 | $603,489.43 | $603,489.43 | $603,489.43 | $603,489.43 | $603,489.43 | $603,489.43 | $603,489.43 | $603,489.43 | $603,489.43 | $603,489.43 |

| 2011 | $92,166.62 | $1,400,737.50 | $1,048,110.32 | $881,485.80 | $624,611.56 | $624,611.56 | $624,611.56 | $624,611.56 | $624,611.56 | $624,611.56 | $624,611.56 | $624,611.56 | $624,611.56 | $624,611.56 |

We can also easily sum and collapse that aggregation, as it is a Stream`:

buildingAhotel['subtotal_egi'].sum()

| date | Effective Gross Income for c0348c0f-a31f-421b-b6bc-0fe0d5ea947f [buildingAhotel] Aggregation (sum) |

|---|---|

| 2001-12-31 00:00:00 | $6,854,263.68 |

| 2002-12-31 00:00:00 | $7,094,162.91 |

| 2003-12-31 00:00:00 | $7,342,458.61 |

| 2004-12-31 00:00:00 | $7,599,444.66 |

| 2005-12-31 00:00:00 | $7,865,425.23 |

| 2006-12-31 00:00:00 | $8,140,715.11 |

| 2007-12-31 00:00:00 | $8,425,640.14 |

| 2008-12-31 00:00:00 | $8,720,537.54 |

| 2009-12-31 00:00:00 | $9,025,756.36 |

| 2010-12-31 00:00:00 | $9,341,657.83 |

| 2011-12-31 00:00:00 | $9,668,615.85 |

buildingAhotel['subtotal_egi'].sum().collapse()

| date | Effective Gross Income for c0348c0f-a31f-421b-b6bc-0fe0d5ea947f [buildingAhotel] Aggregation (sum) |

|---|---|

| 2011-12-31 00:00:00 | $90,078,677.93 |

The above subtotals the Effective Gross Income (EGI) for the hotel space of Building A over the hold period of the asset.

We can then do this for all Entitys in the graph, and plot the results:

sunburst = spatial_containment.sunburst(property='subtotal_egi')

treemap = spatial_containment.treemap(property='subtotal_egi')

fig = plotly.subplots.make_subplots(

rows=2, cols=1,

specs=[[{"type": "sunburst"}], [{"type": "treemap"}]],

subplot_titles=('Effective Gross Income - Sunburst Plot', 'Effective Gross Income - Treemap Plot'))

fig.append_trace(sunburst, row=1, col=1)

fig.append_trace(treemap, row=2, col=1)

filename='aggregate_egis_chart.html'

py.plot(fig, filename=f'_static/{filename}', auto_open=False)

IFrame(src=f'_static/{filename}', width='100%', height=800 * len(fig.data))

Cost-generating Entities#

Let’s now do the same for the cost-generating Entitys. While it is routine to

register revenue-generating Flows with Entitys that have lettable or

sellable floor space, the convention to also register all cost-generating

Flows with only those same Entitys is possibly only done out of convenience

rather than accuracy.

For example, both operating and capital expenses may be attributed to building systems (e.g. maintenance, upgrading, & replacement of MEP or facade componentry) that are not coincident with the floor space they are servicing. I.e., the convention to average (sub)total costs across (sub)total floor space may be misleading, especially when attempting to compare different scenarios at different resolutions (See [dNG18], 5.4 Flaw of Averages).

By virtue of Rangekeeper’s multi-faceted approach to its object model, costs

can be attributed and aggregated to Entitys that are not spatially coincident

with the revenue-generating Entitys; in the example design, we will

use the ‘services’ relationship-type to register and aggregate some of these,

while space-specific costs will be registered and aggregated via spatial

containment:

Operational and Capital Expenses of Building Utilities & Systems#

Of course, in a simplified model and without knowing design and engineering details for the property, costs for operational and capital expenses will be calculated from some proportional rate of spatial characteristics of the building. In this example, we will use the following as simplifications of how these types of costs may be calculated. Note that this is more a demonstration of methodology, and in practice would adjust to real-world data about the specific building systems and their costs.

‘Floorplate-derived’ Operational and Capital Expenses will be calculated as a function of the subtotal floorplate area of ‘building’

Entitys. One could think of this as representing the cost of operating the floor’s MEP, or maintaining, repairing and upgrading elements on the floors themselves (e.g. FF&E)‘Facade-derived’ Operational Expenses will be calculated as a function of the surface area of ‘building’

Entity. This would represent the cost of facade maintenance, repair or replacement.‘Utility-derived’ Capital Expenses will be calculated as a function of the volume of ‘utility’

Entitys. This represents the cost of repairing and upgrading the building’s MEP and transportation systems.

Cost Flows per Entity#

There are some properties of Entitys that we need to produce before we can

calculate Flows off them. In this case we need to produce the facade area

for any Entitys that have ‘perimeter’ and ‘ftf’ (Floor-to-Floor height)

properties:

# Aggregate Facade Areas:

for (entityId, entity) in property.get_entities().items():

if hasattr(entity, 'perimeter') & hasattr(entity, 'ftf'):

entity['facade_area'] = entity['perimeter'] * entity['ftf']

spatial_containment.aggregate(

property='facade_area',

label='subtotal_facade_area')

We now set up operational and capital costing parameters that are based off either areas or volume, as well as growth rates:

floor_opex_per_area_pa = dict(

hotel=-175,

retail=-225,

residential=-125,

parking=-65,

)

facade_opex_per_area_pa = dict(

hotel=-50,

retail=-100,

residential=-50,

parking=-25,

)

opex_growth_rate = 0.035

floor_capex_per_area_pa = dict(

hotel=-100,

retail=-150,

residential=-75,

parking=-50,

)

cores_capex_per_vol_pa = -100

plant_capex_per_vol_pa = -1000

capex_growth_rate = 0.035

Now we can set up our Costs class to produce cost Flows and Streams:

class Costs:

def __init__(

self,

params: dict,

spans: Spans):

self.params = params

self.spans = spans

@rk.update_class(Costs)

class Costs:

def generate_space_costs(self):

floor_opex = rk.flux.Flow.from_projection(

name='Floor-derived Operating Expenses',

value=self.params['initial_floor_opex'],

proj=rk.projection.Extrapolation(

form=rk.extrapolation.Compounding(

rate=self.params['opex_growth_rate']),

sequence=self.spans.calc_span.to_sequence(frequency=self.params['frequency'])),

units=currency.units)

facade_opex = rk.flux.Flow.from_projection(

name='Facade-derived Operating Expenses',

value=self.params['initial_facade_opex'],

proj=rk.projection.Extrapolation(

form=rk.extrapolation.Compounding(

rate=self.params['opex_growth_rate']),

sequence=self.spans.calc_span.to_sequence(frequency=self.params['frequency'])),

units=currency.units)

self.opex = rk.flux.Stream(

name='Space Operating Expenses',

flows=[floor_opex, facade_opex],

frequency=self.params['frequency'])

floor_capex = rk.flux.Flow.from_projection(

name='Floor-derived Capital Expenses',

value=self.params['initial_floor_capex'],

proj=rk.projection.Extrapolation(

form=rk.extrapolation.Compounding(

rate=self.params['capex_growth_rate']),

sequence=self.spans.calc_span.to_sequence(frequency=rk.duration.Type.SEMIDECADE)),

units=currency.units)

self.floor_capex = floor_capex.trim_to_span(self.spans.calc_span) # This is to avoid issues with using >yearly periodicity in projection

We will split the generation of space-based costs from the utility-based costs,

as they will be applied to different Entity types:

@rk.update_class(Costs)

class Costs:

def generate_utils_costs(self):

utils_capex = rk.flux.Flow.from_projection(

name='Utilities-derived Capital Expenses',

value=self.params['initial_utility_capex'],

proj=rk.projection.Extrapolation(

form=rk.extrapolation.Compounding(

rate=self.params['capex_growth_rate']),

sequence=self.spans.calc_span.to_sequence(frequency=rk.duration.Type.SEMIDECADE)),

units=currency.units)

self.utils_capex = utils_capex.trim_to_span(self.spans.calc_span) # This is to avoid issues with using >yearly periodicity in projection

Now we can run the Costs class against ‘floor’ and ‘utilities’ Entitys:

for floor in floors:

floor_params = params.copy()

floor_params['initial_floor_opex'] = floor_opex_per_area_pa[floor['use']] * floor['subtotal_gfa']

floor_params['initial_facade_opex'] = facade_opex_per_area_pa[floor['use']] * floor['subtotal_facade_area']

floor_params['initial_floor_capex'] = floor_capex_per_area_pa[floor['use']] * floor['subtotal_gfa']

floor_params['opex_growth_rate'] = opex_growth_rate

floor_params['capex_growth_rate'] = capex_growth_rate

floor['params'] = floor_params

floor['events'] = {} if not hasattr(floor, 'events') else floor['events']

costs = Costs(

params=floor_params,

spans=spans)

costs.generate_space_costs()

floor['opex'] = costs.opex

floor['capex'] = costs.floor_capex

The utilities are a bit different, as (for this example), their capex is a factor of their volume. We can see that the utilities are the cores and plant of the property:

IFrame("https://app.speckle.systems/projects/c0f66c35e3/models/119ad04487#savedView%3D%7B%2522id%2522%3A%2522b8d61129f8%2522%7D", width='100%', height=800)

utilities = property.filter_by_type(entity_type='utilities', is_assembly=False)

for utility in utilities.get_entities().values():

utility_params = params.copy()

if 'plant' in utility['name']:

utility_params['initial_utility_capex'] = plant_capex_per_vol_pa * utility['volume']

elif 'cores' in utility['name']:

utility_params['initial_utility_capex'] = cores_capex_per_vol_pa * utility['volume']

utility_params['capex_growth_rate'] = capex_growth_rate

utility['params'] = utility_params

utility['events'] = {} if not hasattr(utility, 'events') else utility['events']

costs = Costs(

params=utility_params,

spans=spans)

costs.generate_utils_costs()

utility['capex'] = costs.utils_capex

list(utilities.get_entities().values())[0]['capex']

| Utilities-derived Capital Expenses | |

|---|---|

| 2005-12-31 00:00:00 | -$865,663.39 |

| 2010-12-31 00:00:00 | -$895,961.61 |

And finally aggregate them:

def aggregate_opex(**kwargs):

return rk.graph.Entity.aggregate_flows(

**kwargs,

name='Operational Expenses',

frequency=frequency)

property.aggregate(

function=aggregate_opex,

property='opex',

label='subtotal_opex',

relationship_type='spatiallyContains')

def aggregate_capex(**kwargs):

return rk.graph.Entity.aggregate_flows(

**kwargs,

name='Capital Expenses',

frequency=frequency)

property.aggregate(

function=aggregate_capex,

property='capex',

label='subtotal_capex',

relationship_type='spatiallyContains')

If we wish to see the ultimate aggregation of those costs, we can do so by

totalling them at their root Entity:

property_opex = property.get_roots()['spatiallyContains'][0]['subtotal_opex'].sum()

property_capex = property.get_roots()['spatiallyContains'][0]['subtotal_capex'].sum()

print('Property Average Periodic OPEX: ${:,.2f}'.format(property_opex.movements.mean()))

print('Property Average Periodic CAPEX: ${:,.2f}'.format(property_capex.movements.mean()))

Property Average Periodic OPEX: $-7,488,734.31

Property Average Periodic CAPEX: $-2,007,558.91

To get a sense check if this is reasonable, we can compare the opex and capex

to the PGI. First let’s aggregate the PGI for all Entitys:

def aggregate_pgis(**kwargs):

return rk.graph.Entity.aggregate_flows(

**kwargs,

name='Potential Gross Income',

frequency=frequency)

spatial_containment.aggregate(

property='pgi',

function=aggregate_pgis,

label='subtotal_pgi')

And total it to the root Entity:

property_pgi = property.get_roots()['spatiallyContains'][0]['subtotal_pgi'].sum()

print('Property Average Periodic PGI: ${:,.2f}'.format(property_pgi.movements.mean()))

Property Average Periodic PGI: $18,918,012.54

Now we can calculate the Expenses ratios:

print('Property OpEx as proportion of PGI: {:.2%}'.format(-property_opex.movements.mean() / property_pgi.movements.mean()))

Property OpEx as proportion of PGI: 39.59%

print('Property CapEx as proportion of PGI: {:.2%}'.format(-property_capex.movements.mean() / property_pgi.movements.mean()))

Property CapEx as proportion of PGI: 10.61%

Looking at just the cost-producing Entitys, we can see that in the OpEx and

CapEx breakdowns, there is a significant amount of cost generated by non-floor

(i.e., non-revenue-generating) Entitys, like cores and plant. This type of

analysis is important in understanding the cost drivers of a property, and

where the most effective cost-saving measures could be applied.

opex = spatial_containment.sunburst(property='subtotal_opex')

capex = spatial_containment.sunburst(property='subtotal_capex')

fig = plotly.subplots.make_subplots(

rows=2, cols=1,

specs=[[{"type": "sunburst"}], [{"type": "sunburst"}]],

subplot_titles=('Total Operational Expenses', 'Total Capital Expenses'))

fig.append_trace(opex, row=1, col=1)

fig.append_trace(capex, row=2, col=1)

filename='aggregate_exp_chart.html'

py.plot(fig, filename=f'_static/{filename}', auto_open=False)

IFrame(src=f'_static/{filename}', width='100%', height=800 * len(fig.data))

Calculating Overall Valuation#

Now that we have our revenues and cost line items (Flows) generated per

Entity, we can accumulate them into Net Operating Income (NOI) and

Net Annual Cashflow (NACF) subtotals, as well as the reversion (disposition, or

sale) of the whole asset, in order to determine the overall valuation of the

property.

We can also calculate the net position of each Entity as its ‘Net Annual

Cashflow (NACF)’:

for entity in property.get_entities().values():

noi = [getattr(entity, 'egi', None), getattr(entity, 'opex', None)]

noi = [flow.sum() if isinstance(flow, rk.flux.Stream) else flow for flow in list(filter(None, noi))]

if len(noi) > 0:

entity['noi'] = rk.flux.Stream(

name='Net Operating Income',

flows=noi,

frequency=frequency)

capex = getattr(entity, 'capex', None)

if capex is not None:

entity['nacf'] = rk.flux.Stream(

name='Net Annual Cashflow',

flows=entity['noi'].flows + [capex],

frequency=frequency)

def aggregate_noi(**kwargs):

return rk.graph.Entity.aggregate_flows(

**kwargs,

name='Net Operating Income',

frequency=frequency)

property.aggregate(

function=aggregate_noi,

property='noi',

label='subtotal_noi',

relationship_type='spatiallyContains')

def aggregate_nacf(**kwargs):

return rk.graph.Entity.aggregate_flows(

**kwargs,

name='Net Annual Cashflow',

frequency=frequency)

property.aggregate(

function=aggregate_nacf,

property='nacf',

label='subtotal_nacf',

relationship_type='spatiallyContains')

Reversion#

To calculate the reversion cashflow, we set up a period that spans the 10th year

of the project. This only applies to the asset as a whole, so it is recorded

at the root Entity:

root = property.get_roots()['spatiallyContains'][0]

reversion_span = rk.duration.Span.from_duration(

name='Reversion',

date=params['start_date'] + pd.DateOffset(years=9),

duration=params['frequency'])

exit_caprate = 0.05

reversion_flow = rk.flux.Flow.from_projection(

name='Reversion',

value=root['subtotal_nacf'].sum().movements.values[-1] / exit_caprate,

proj=rk.projection.Distribution(

form=rk.distribution.Uniform(),

sequence=reversion_span.to_sequence(frequency=params['frequency'])),

units=currency.units)

root['reversion'] = reversion_flow

reversion_flow

| Reversion | |

|---|---|

| 2010-12-31 00:00:00 | $284,674,637.71 |

Now we can aggregate the net and reversion cashflows in the root Entity in

order to derive the project’s complete cashflows:

net_cashflows_with_reversion = (rk.flux.Stream(

name='Net Cashflow with Reversion',

flows=[root['subtotal_nacf'].sum(), root['reversion']],

frequency=rk.duration.Type.YEAR)

.trim_to_span(

rk.duration.Span(

start_date=params['start_date'],

end_date=reversion_span.end_date)

)

)

root['nacf_reversion'] = net_cashflows_with_reversion

net_cashflows_with_reversion

| Net Annual Cashflow for afe8e730-ad0f-4c2a-a15c-e249e4518fa8 [property] Aggregation (sum) | Reversion | |

|---|---|---|

| 2001 | $8,134,691.89 | 0 |

| 2002 | $8,599,446.40 | 0 |

| 2003 | $9,091,532.28 | 0 |

| 2004 | $9,612,601.91 | 0 |

| 2005 | $6,862,704.94 | 0 |

| 2006 | $10,748,821.65 | 0 |

| 2007 | $11,367,816.34 | 0 |

| 2008 | $12,023,498.34 | 0 |

| 2009 | $12,718,103.14 | 0 |

| 2010 | $10,036,741.15 | $284,674,637.71 |

table = rk.flux.Stream(

name='Table 1.1',

flows=[

root['subtotal_egi'].sum(),

root['subtotal_opex'].sum(),

root['subtotal_noi'].sum(),

root['subtotal_capex'].sum(),

root['subtotal_nacf'].sum(),

root['reversion'],

root['nacf_reversion'].sum()

],

frequency=rk.duration.Type.YEAR

)

table

| Effective Gross Income for afe8e730-ad0f-4c2a-a15c-e249e4518fa8 [property] Aggregation (sum) | Operational Expenses for afe8e730-ad0f-4c2a-a15c-e249e4518fa8 [property] Aggregation (sum) | Net Operating Income for afe8e730-ad0f-4c2a-a15c-e249e4518fa8 [property] Aggregation (sum) | Capital Expenses for afe8e730-ad0f-4c2a-a15c-e249e4518fa8 [property] Aggregation (sum) | Net Annual Cashflow for afe8e730-ad0f-4c2a-a15c-e249e4518fa8 [property] Aggregation (sum) | Reversion | Net Cashflow with Reversion (sum) | |

|---|---|---|---|---|---|---|---|

| 2001 | $14,402,849.55 | -$6,268,157.66 | $8,134,691.89 | 0 | $8,134,691.89 | 0 | $8,134,691.89 |

| 2002 | $15,086,989.58 | -$6,487,543.18 | $8,599,446.40 | 0 | $8,599,446.40 | 0 | $8,599,446.40 |

| 2003 | $15,806,139.47 | -$6,714,607.19 | $9,091,532.28 | 0 | $9,091,532.28 | 0 | $9,091,532.28 |

| 2004 | $16,562,220.35 | -$6,949,618.44 | $9,612,601.91 | 0 | $9,612,601.91 | 0 | $9,612,601.91 |

| 2005 | $17,357,265.38 | -$7,192,855.09 | $10,164,410.29 | -$5,919,092.61 | $6,862,704.94 | 0 | $6,862,704.94 |

| 2006 | $18,193,426.66 | -$7,444,605.02 | $10,748,821.65 | $0.00 | $10,748,821.65 | 0 | $10,748,821.65 |

| 2007 | $19,072,982.53 | -$7,705,166.19 | $11,367,816.34 | $0.00 | $11,367,816.34 | 0 | $11,367,816.34 |

| 2008 | $19,998,345.35 | -$7,974,847.01 | $12,023,498.34 | $0.00 | $12,023,498.34 | 0 | $12,023,498.34 |

| 2009 | $20,972,069.80 | -$8,253,966.66 | $12,718,103.14 | $0.00 | $12,718,103.14 | 0 | $12,718,103.14 |

| 2010 | $21,996,861.68 | -$8,542,855.49 | $13,454,006.19 | -$6,126,260.85 | $10,036,741.15 | $284,674,637.71 | $294,711,378.86 |

| 2011 | $23,075,587.32 | -$8,841,855.43 | $14,233,731.89 | 0 | $14,233,731.89 | 0 | 0 |

Valuation#

With our net cashflows including reversion, if we specify a discount rate, we can calculate the present value of the property:

discount_rate = 0.07

pvs = root['nacf_reversion'].sum().pv(

name='Present Value',

frequency=rk.duration.Type.YEAR,

rate=discount_rate)

pvs

| Present Value | |

|---|---|

| 2001-12-31 00:00:00 | $7,602,515.78 |

| 2002-12-31 00:00:00 | $7,511,089.53 |

| 2003-12-31 00:00:00 | $7,421,398.50 |

| 2004-12-31 00:00:00 | $7,333,407.97 |

| 2005-12-31 00:00:00 | $4,893,013.78 |

| 2006-12-31 00:00:00 | $7,162,393.72 |

| 2007-12-31 00:00:00 | $7,079,304.69 |

| 2008-12-31 00:00:00 | $6,997,785.50 |

| 2009-12-31 00:00:00 | $6,917,805.44 |

| 2010-12-31 00:00:00 | $149,816,320.83 |

property_pv = pvs.collapse().movements.item()

print('Property PV: ${:,.0f}'.format(property_pv))

Property PV: $212,735,036